Insurance News

Those with bank accounts --SBI, Post office or any other banks -- Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) eligible beneficiaries who consent to join or activate auto-debit, must know how to stop the money being deducted.

Those with bank accounts --SBI, Post office or any other banks -- who consent to join or activate auto-debit and are in the age range of 18 to 50 are eligible for the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY).

Here are 6 Tips for Avoiding Claim Rejection and Resolving Disputes in Health Insurance.

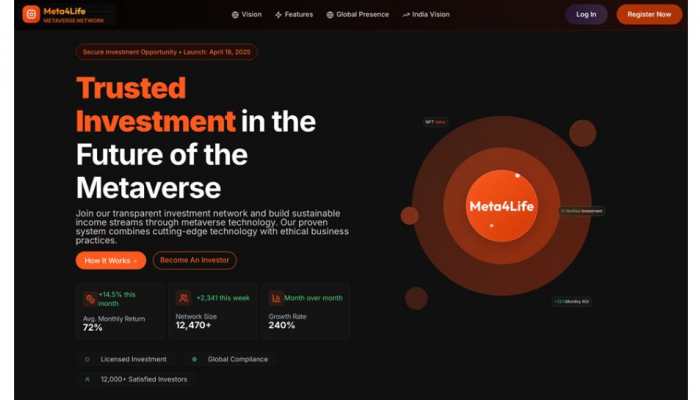

Empowering Investors and Redefining the Future of the Metaverse.

If you find out that Rs 20 has been auto-debited from your account, you will have to visit the bank branch in order to stop it. But why was the money deducted? Find out.

Private insurers saw a surge in retail sum assured by 41 per cent YoY in 9M FY2025 (30 per cent in FY2024), higher than the retail NBP growth of 17 per cent (7 per cent in FY2024).

Last year, the Insurance Regulatory and Development Authority of India (IRDAI) had extended free look period for policyholders period from 15 days to 30 days.

Depending on the plan he or she selects, an annual premium of Rs 436 is auto-debited from the subscriber's bank account on or before May 31 of each annual coverage term under Pradhan Mantri Jeevan Jyoti Bima Yojana.

These rule changes, effective from 1st August 2024, will impact your finances. Check what's new.

The District Consumer Dispute Redressal Commission (Central District) was hearing the complaint of Nishchal Jain alleging a deficiency in services by the insurer for repudiating his insurance claim.

The circular on IRDAI (Insurance Products) Regulations 2024 --General Insurance that replaces all earlier Guidelines/circulars of General Insurance Products, is applicable immediately.

IRDAI Master Circular On General Insurance 2024: Among the several points that have been mentioned in the circular, the most flexibility has been given on cancellation of insurance policy.

Insurance Regulatory and Development Authority of India has said that two new insurance rules are applicable from 01 April 2024.

IRDAI said that it has approved eight principle-based consolidated regulations, following the comprehensive review of regulatory framework for insurance sector.

Gupta said that even though the upcoming budget is a Vote on Account, the insurance sector sees continuation of the infra capex and self-dependency themes.

The cost of premiums and deductibles is one of the most important factors to look into.

Ensure to review the waiting period according as per your requirements.

Ensure that the health insurance policy extends coverage to critical illnesses.

Loading...

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)